News and Articles

The latest news and articles in the world of Short-Term Rentals.

2025 Christmas Book List

How to Launch Your Vacation Rental Business: 5 Essential Tips for Success

Running a vacation rental business is an enticing prospect—welcoming guests from around the world, generating a steady income, and showcasing a property you’ve poured your hea...

How to Pre-Filter Bad Airbnb Guests in 2025: Top Vetting Tools and Strategies

Hosting on Airbnb can be a rewarding experience, but even guests with excellent 5-star reviews can occasionally leave your property in disarray or disturb the neighbors, as yo...

How To Build Your Personal Brand

Building a personal brand has become increasingly important in recent years, particularly for short-term rental owners seeking to differentiate themselves in a competitive mar...

Profit First for STR Hosts: Simplify Your Finances in 2025

Running a short-term rental (STR) is a unique business that blends hospitality, real estate, and operational tasks such as cleaning and property management. Unlike traditional...

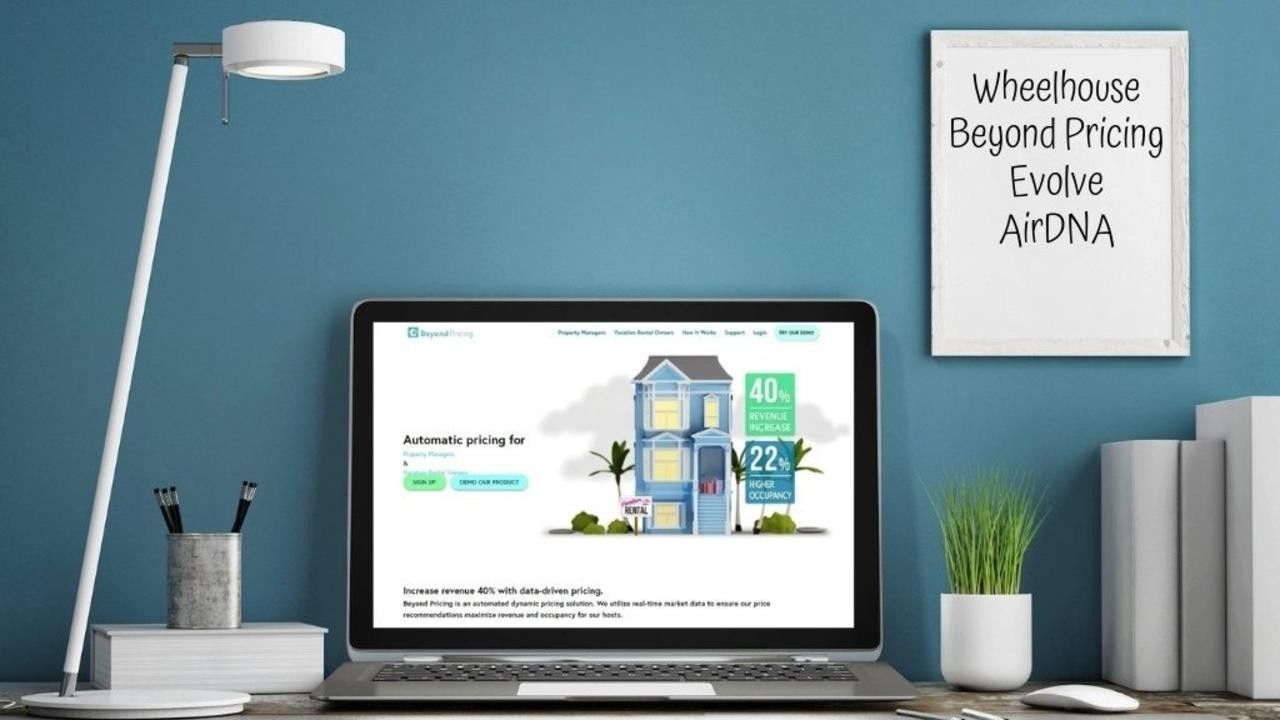

Top Dynamic Pricing Tools for STR Hosts in 2025: Maximize Revenue, Minimize Hassle

In the fiercely competitive world of short-term rentals (STRs), setting the right price can make or break your business. Price too low, and you attract low-quality guests wh...

Maine, Colorado, and Arkansas Updates!

Note: We have a Detailed Overview in our Members' Community under the Government - Restrictions, Regulations, and Rules circle.

Maine’s LD 283: A Tax Scare Defeated

Main...

Top STR Tech Trends for 2025: Boost Revenue, Delight Guests, and Build a Legacy

In the fast-evolving short-term rental (STR) industry, staying ahead means embracing technology that simplifies operations, maximizes revenue, and creates unforgettable guest ...

Top Hosting Platforms for Your Short-Term Rental (Beyond Airbnb) in 2025

Airbnb may be the first name that comes to mind for short-term rentals (STRs), but it’s not the only player in the game—nor always the best fit for every host. While Airbnb’...

STR Hosts, 2025 Is a Game-Changer for Your Rights!

Hey, awesome short-term rental fam!

We've been discussing 2025’s legislative session and how it is shaking things up with bills in New Mexico, Ohio, Vermont, and Washington...